If homesteading is calling your name, there are some things you need to consider before you quit your job & go off grid! Health insurance is an extremely important consideration for any homesteader – here are some options to consider for you and your family.

You’ve done it!

You’ve made the choice to jump off the hamster wheel and to embrace the wild, rugged homestead lifestyle! You’re dreaming of harvesting healthy fresh food from your garden. Adorable livestock drift into your dreams on a regular basis. And, of course, you are devouring every article in Mother Earth News!

It’s a fantastic feeling!

But, then, as you continue down the “homesteading dream” rabbit hole, you start to hit a few bumps. And then it hits you:

“What the heck am I going to do about health insurance?!”

Ahhh health insurance… everyone’s favorite topic. ? While it might not be fun to think about, it is a necessary evil that we all have to deal with. For many people, health insurance is a major nail in the coffin of their dreams of moving into the woods away from modern conveniences to live the homestead life.

So what exactly do homesteaders do about insurance? Well, I would love to give you some voodoo-hoodoo magical solution but frankly, I don’t have one. I’m sorry, but here comes: the tough love. If you want insurance, the only solution is to pay for insurance or work for insurance.

Let me just warn you: It’s not fun or fair. It will be a sacrifice and it will probably suck. But, you can make it all work!

What we do about health insurance

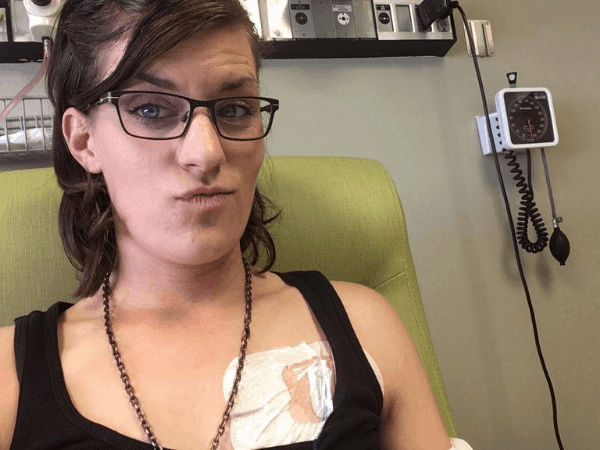

I can’t tell you what every homesteader does about insurance, but I can tell you what we do. Insurance is a biggie for us. When Lindy was diagnosed with Multiple Sclerosis at the age of 20, we knew our lives would never be “normal” again. A lot of what we do, including insurance, is based around keeping her as healthy. Because the healthier that she stays, the longer we can continue living this lifestyle that we love.

Insurance is an absolutely “must have” in our life! With her monthly infusions, the medicine alone (at an in network provider) is around $19,000 per month. That’s just the medicine. Luckily, there are plans to help cover some of the costs. But we are often left with large bills, even after insurance and assistance programs. That isn’t factoring in the twice a year MRI’s, the pre-infusion bloodwork, the skilled nursing care, or the facilities. And it certainly isn’t including the multiple surgeries that have been necessary over the years to maintain quality of life.

I tell you this not for a pity party, but to show you that I truly understand how much it sucks and how unfair it is. The patient is always the loser in this market. And, right now, there really doesn’t seem to be a way around it.

But at the end of the day, my family’s health is more important to me than anything else. Which is why we make the sacrifices we do to ensure that we have good medical insurance.

If I’m healthy, do I really need medical insurance right now?

Even if you don’t have medical issues in your daily life, I would never advise going without some form of insurance. And it’s not because I am in anyway condoning the American medical and insurance institutions. But, Lindy and I know very well that NOTHING can make a person go bankrupt faster than a medical emergency!

I have seen people suggest on homesteading forums that “true homesteaders” (oh, yes, here we go again with the “true homesteader” requirements ?) shouldn’t need insurance. They argue that we should all have enough in savings to take care of our medical needs up front. I’ve also seen it suggested that we should all be paying our own way in this world and not relying on others or insurance.

Let me tell you, I haven’t had that hardy of a belly laugh in many years!

Yeah, maybe that method worked back in the original homesteading days when your horse farrier was also your gynecologist, but the world is different now! And you are no less of a homesteader because you have a job, insurance and go to a dentist that doesn’t also work on horses. It is 2020 after all!

Medical emergencies happen on the homestead… and in life!

Let’s just say that it seems a bit idiotic to think that you can save enough money to prepare for a medical emergency. I don’t know a single person who plans to have a heart attack. No one plans to get third degree burns over 50% of their body from a brush burn gone bad. And certainly no one plans to be diagnosed with cancer or a chronic disease.

But it happens. And when it does, you’re going to have a hard time not going broke even WITH insurance.

With major medical emergencies, we aren’t talking about medical expenses that number in the thousands of dollars. We are talking about hundreds of thousands dollars that can be wracked up in just a week or so in the hospital. I’m not making these numbers up. Believe me, this is our everyday life. Medical expenses in the US are out of control!

That being said, there are some options that you might want to consider in order to keep your family insured while still homesteading. Your options will vary based on where you live (assuming you are in the US) and whether or not you are employed. None of the options are perfect and they all have a lot of disadvantages. The only thing I can suggest is to do the best you can and to make the best choice possible for your family.

Health Insurance Options for Homesteaders:

Group Plans:

Group plans are insurance plans offered through an employer. These are healthcare plans that are not offered to the public and often have lower deductibles and better benefits than public plans. Employers usually pay a certain amount towards their employee’s healthcare. However, many employees will still need to pay for portions of their benefits, especially if they want their entire family covered on the plan.

Our experience with Group Plans:

This is how we maintained our insurance for 10+ years. I worked for a municipality that offered one of the best healthcare plans in the state. We save tens of thousands of dollars each year because of our insurance plan. When I was employed full-time, our healthcare was practically free. My employer paid all but about $40 of the plan for both Lindy and I. When I switched to part-time work, I had to pay about half of the cost (which is still sooo much cheaper than any public plan).

Did I love having to drive to 45 minutes into the city to work behind a desk each day? No, but that was our reality and it was the best option at the time. Even after I dropped down to part-time work, I would have gone back to full-time in a heartbeat if that’s what I needed to do in order to keep our benefits. It’s that important to us. I know this isn’t the case for everyone, but it is for us.

So, if insurance is a “must” for your family like it is for ours, it might be a good idea to consider having at least one member of the family work at a job that offers good benefits. I know many homestead couples who operate this way: one person working in the city and the other maintaining the homestead. It’s actually a pretty good option to be able to achieve the “necessary evils” like retirement funds, insurance and other benefits.

COBRA:

COBRA is an insurance option that is offered to employees post-employment. So, if you had a job with benefits that you decided to quit/got laid off from, you would be able to keep those same benefits for a limited period of time. Generally, it is quite expensive to buy COBRA coverage, but it may be an option for a short while if you are transitioning away from traditional employment. Again, this is not a long-term solution, but rather a band-aid until you can find a new healthcare plan.

Public Health Plan:

Public health plans are available to anyone. You can sign up online at healthcare.gov or contact a broker who can help walk you through the process at no additional cost. Plans vary from state to state and there are often a few different providers that you can choose from. Monthly premiums and deductibles also vary.

Our experience with Public Health Plans:

Since we moved to Washington in February, I work at home and Lindy doesn’t get insurance through her employer. So we now have a public health insurance plan. It’s been a bit of a sh!t show to be honest. I definitely miss my City benefit package, although being able to work at home has been amazing! But, having to deal with this mess was literally the reason I stayed at my last job for so long.

If you have health issues that require special treatments like Lindy does, finding a public plan can be a challenge. We’ve already been bumped off of one insurance plan. They said they would cover Lindy’s infusions and we verified it with two of their agents. After coordinating the medical facility, the neurologist, the infusion center, the medicine company and the pharmacy, Lindy got her first infusion in Washington. Aaaand then insurance said they wouldn’t cover it. ?

Then, after spending the next two months getting set up with a new insurance provider, the medical center and neurologist released Lindy as a patient because she was “uninsured” for her first infusion. So now we have insurance and are still struggling to find a new neurologist and infusion center. And yes, it’s been six months of this!

That may have been a tangent! But, it’s all just to say that if you are finding a public health plan, make sure they actually cover what they say they do. Talk to multiple agents. Then talk to more! And I wish you good luck – you’re sadly probably going to need it. ?

Medicare:

Medicare is a government health plan that is available to adults who are age 65 or older. Again, the cost varies based on what you qualify for. For some people, a public health plan may be cheaper and/or provide better or similar coverage.

Medicaid:

Medicaid is a government provided healthcare option that allows access to free or low-cost medical care for qualifying individuals, like nursing or pregnant mothers, low-income children and parents, and certain elderly people. In order to qualify, participants need to make less than a set amount annually. This can be a good option for families who need extra assistance.

Christian Health Co-ops:

There are some Christian health co-ops that intend to act as an alternative to traditional insurance. Basically, you pay into the system, along with others, and that fund is used to help cover medical expenses as they arise for the members. I have no personal experience with these. We actually don’t qualify for these types of plans because of Lindy’s health issues.

Personally, I would be very hesitant about joining one of these. Don’t get me wrong – I’m sure they serve a certain purpose! But if a major accident or life changing event happened that required extended hospital stays and medical care, I’m assuming that these funds wouldn’t even begin to cover the expenses. Medical care can also be much more expensive because you will not receive the “in network” rate due to lack of insurance.

I would also assume that if you develop a serious condition that requires ongoing treatment, you could be dropped from the co-op. That would leave you searching for insurance in the middle of dealing with your health issues. You may also be labeled with a pre-existing condition at that point, which can make it harder to find good coverage. Again, I have no experience with these co-ops, but it’s not something that I would personally risk.

So, there you have it: the best of the worst options for insuring yourself as a homesteader!

Bottom line: Insurance is a very personal choice that you will have to make for yourself and your family. It’s not a decision to be made lightly as it could effect both your physical and financial health long-term. Take your time to make the best decision that you can to support both your family and your homesteading life. And, remember that it is possible to be a “true” homesteader and still have insurance! ?

Great article. You hit every point needed.

Thanks, Sharon! It’s definitely not an easy choice no matter how you choose to proceed. We all just do the best we can and hope for better options to come along in the future. Best of luck to you and your homestead!